Advisor Assessment: Using adhoc reports to evaluate Advisors?

Are you only using traditional methods like Track Record, Batting Average, Information Ratio, etc? These give general point in time and nuanced assessments, which make the evaluation including for trend, relative comparisons, path profiles, situational capture, etc. difficult or open for interpretation. Our system supplements the traditional analysis with a proprietary measure that allows not only point in time but also relative and trend evaluations.

Our research – for implementing the Advisor Assessment Framework.

Let us assess your Advisor’s Handicap!

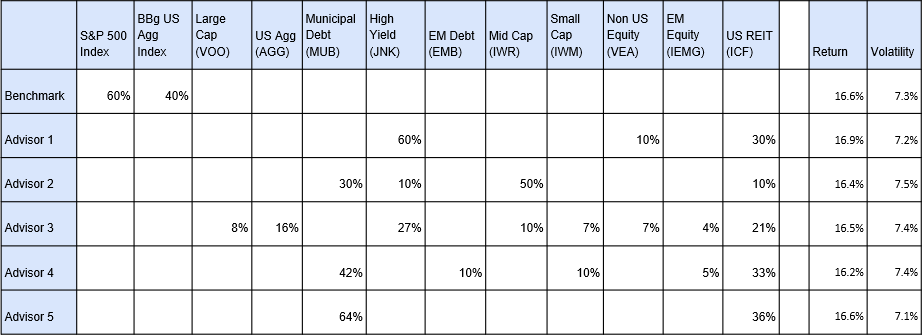

The Advisor Assessment Framework just needs the performance of the Advisor and an objective as data inputs. Below animation assumes that you are evaluating five Advisors on December 31st, 2021, who have near similar first order risk-return profiles (Return and Volatility are calculated using data from 2020-12-31 to 2021-12-31), versus an objective as represented by a (60% SP500 TR US +40% US Agg Bond TR USD) blend benchmark – see table below (Advisor Holdings).

This makes the evaluation for point-in-time, trend, relative comparisons, path profiles, situational capture, etc easy and transparent.

- Scorecard – measures the play-by-play performance of an Advisor in relation to a benchmark at each interval of the evaluation period.

- Fairway Average – measures the propensity of an Advisor to take more or less risk than the benchmark.

- Handicap – measures the Advisor’s performance across periods that can be looked at as Regimes or Portfolios.

The simple framework illustrates how much better or worse the Advisor is actually doing versus the benchmark (at each interval and in total), the path profile across the intervals, performance across market regimes, one of peaks/troughs and so on. Assess the Advisor’s ability to meet or beat the target objective and also shed light on the Advisor’s approach to the green (pun intended!). This is important because in addition to evaluating the performance around an objective,you should also be assessing if the recent performance is in line with expectations, a deviation from the norm, how the performance compares with others, if it fits a pattern, etc. Therein the questions become, (a) expectations around the Advisors ability to navigate the objective, and (b) how well did the Advisor actually perform relative to the objective? Some Advisors have a keen eye on negative performance, some keep an eye on the outliers, some are hot trend followers, and so on – how do you compare to get comfortable with what is really important for you?

The Advisor Assessment Framework does this and has some immediate advantages. First, the framework is driven by the market and its data needs are limited to the Advisor’s performance. When applied uniformly, it normalizes the playing field to evaluate all Advisors on a similar basis via the Scorecards. Second, as with the slope or course ratings that normalize the difficulty of golf courses, markets present themselves as Regimes, and the performance of the Advisors during specific Regimes can be accessed via discrete plays on the Scorecards and assessed collectively as a Handicap. Third, Advisors have their own approaches, possibly via risk selection, to address the markets and these can be assessed via their Fairway Averages. Finally, the Advisor Assessment Framework construct is very flexible and can be easily applied across portfolios, for each Client Risk Profile mapping, on a gross or net basis, with or without client nuances, etc.

As with Golf, markets have the ability for leveling the ego and real handicaps!

Advisor Holdings