About us

We are focused on developing practical AI applications in challenging environments. ASK your daunting questions as we have the ability to harness research, data, and AI methodologies so you can explore the possibilities. We believe:

What can we do for you?

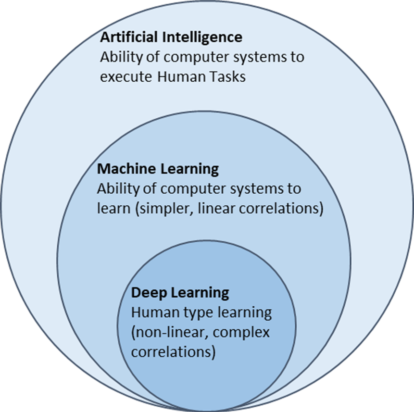

For starters, Artificial Intelligence (AI) is generally defined as the theory and development of computer systems able to perform tasks normally requiring human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages. Machine Learning is a type of AI in which computers use huge amounts of data to learn how to do tasks rather than being programmed to do them. Deep Learning is a type of machine learning in which neural networks discover non-linear, complex relationships from vast amounts of data.

We caution that for suitability, beyond the buzzwords, effective implementation requires knowledge of complex processes for appropriate models and tuning to the pertinent task. Our view is to balance the expectations for the use case depending on the skill/experience level and potential task complexity.

Leadership

Satyan Malhotra, Chief Executive Officer

Dr. Ali Hirsa, Chief Scientific Officer

Platform

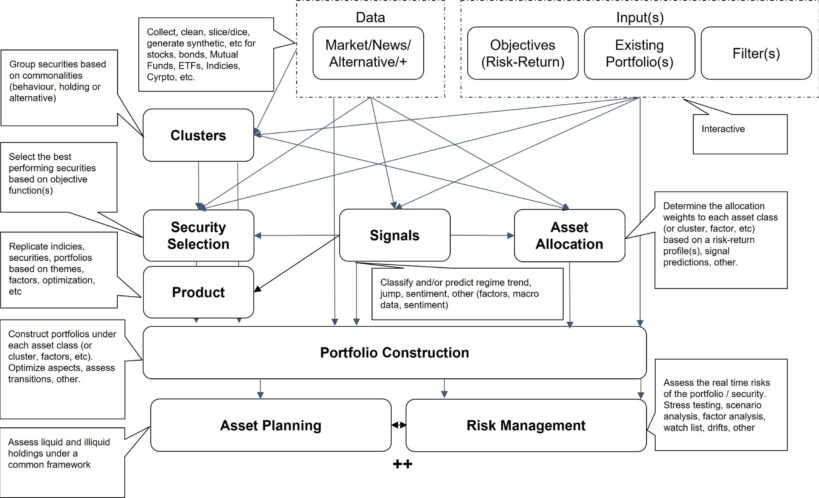

Reimagine Asset Management via a platform based entirely on AI methodologies applied across the investment lifecycle: data mining, regime/signal detection, security selection, asset allocation, portfolio management, risk management, asset planning, product development, other.

As illustrated below, if you want another independent/un-biased datapoint for evaluation across the investment lifecycle, what would the AI screens be?

As such, the platform supplements the Asset Manager’s experience-based, traditional portfolio decision processes with Artificial Intelligence-powered visualizations for,

Engagements

Implementing enhancements can benefit you financially, procedurally, strategically and/or behaviorally. We can help quantify impacts and embedding our systems/processes within your infrastructure.

Asset selection: How much RoT is in your portfolio?

With numerous pitches, professed insights, optimizations, superior modeling, biases, et al how do you know which asset is actually in line with your target? Our system uses your positions to conduct the comparative analysis.

Our research – Explainability Index (EI) and Risk of Target (RoT) are proprietary, mathematically sound and easily explainable measures that do the comparative analysis.

Let us tell you how much RoT is there!

Publications

We believe questioning status-quo hones expertise and yields improvements via pushing the boundaries of AI applications; even in non-stationary markets. And, we don’t believe in black boxes so we publish all our research.